Martin

Jarrett

Dr. iur., Senior Research Fellow

jarrett@mpil.de

Tel. +49 (6221) 482-633

Main Fields of Research:

General International Law (causation and role of domestic law); International Public Law (adjudication of investor-state disputes); and International Investment Law (investor misconduct and role of human rights)

Academic Career:

Employed Positions:

Apr. 2021 – Jul. 2022: Adjunct Lecturer, Ruprecht Karl University of Heidelberg (link)

Since Jan. 2020: Senior Research Fellow, MPIL

Aug. 2018 – Dec. 2019: Senior Lecturer, University of Mannheim

Jul. 2012 – Jul. 2018: Lecturer, University of Mannheim

Academic Qualifications:

- Doctor of Laws (summa cum laude), University of Mannheim (Supervisor: Prof. Dr. Oliver Brand, LL.M.)

- Graduate Diploma of Legal Practice, College of Law (Sydney)

- Bachelor of Laws (first class honours), University of Newcastle (Australia)

- Bachelor of Arts, University of Newcastle (Australia)

Research Stays:

Dec. – Mar. 2019: Visiting Researcher, University of Sydney

Aug. – Sep. 2018: Visiting Researcher, University of Helsinki

Jul. – Aug. 2018: Visiting Researcher, George Washington University

Jul. – Aug. 2017: Visiting Researcher, University of Sydney

Professional Qualification:

Solicitor and Barrister (New South Wales, Australia) (not active)

Recent Publications

-

The Rise of Domestic Courts in International Investment Law.

Oxford University Press, Oxford, 2026, 400 p., forthcoming.

(editor with

Chester Brown,

Stephan Schill).

-

Contributory Fault and Investor Misconduct in Investment Arbitration.

Cambridge University Press,

Cambridge, 2019, 182 p.

Link

-

Trusteeships Over Russian-Owned Investments in Germany. In: Economic Sanctions in International Economic Law: Exploring the Normative Shifts in Response to the Russian-Ukrainian Conflict, Marcin Menkes. Brill, Leiden 2024,

x-x, forthcoming.

-

The Investment-Protection Status of Fossil Fuel–Related Investments in International Investment Law. In: Global Energy Transition and Investment Disputes,

Rahmi Kopar,

Volker Roeben (eds.). Hart Publishing, Oxford 2024,

x-x, forthcoming.

-

Rebalancing Asymmetries between Host States and Investors in Asian ISDS: An Exception for Systemic Corruption. In: Corruption and Illegality in Asian Investment Arbitration,

Bruno Jetin,

Luke Nottage,

Nobu Teramura (eds.). Springer, Singapore 2024,

185-208.

Link

-

ISDS 2.0: Time for a Doctrine of Precedent?

In: Journal of International Economic Law 27, 41-53 (2023). doi: https://doi.org/10.1093/jiel/jgae007.

Link to Text (Open Access)

-

The International Validity of Domestic Law in Investment-Treaty Arbitration.

In: Arbitration International 39(1), 1-18 (2023). doi: https://doi.org/10.1093/arbint/aiad001.

Link to Text (Open Access)

-

Legality Requirements: Managing the Tension between the Domestic and the International Rule of Law. In: Investment Protection Standards and the Rule of Law,

August Reinisch,

Stephan Schill (eds.). Oxford University Press, Oxford 2023,

215-232.

Link to Book

-

Implicit Legality Requirements in Investment-Treaty Arbitration: A Doctrinal Critique of the Current Jurisprudence.

In: Czech Yearbook of International Law 13, 3-22 (2022).

Link to Text (Open Access)

-

Book Review:

Van Harten, Gus:

The Trouble with Foreign Investor Protection, Oxford, 2020.

In: Heidelberg Journal of International Law, 82(1), 269-278, 2022.

Link to Text (Open Access)

-

Extracting Legal Causation from International Investment Law. In: Secondary Rules of Primary Importance: Attribution, Causality, Standard of Review and Evidentiary Rules in International Law,

Gábor Kajtár,

Başak Çalı,

Marko Milanović (eds.). Oxford University Press, Oxford 2022,

124-141.

Link to Chapter

-

Extricating the Illegality Element from Judicial Expropriation. In: Global Values and International Trade Law,

Csongor István Nagy (ed.). Routledge Publishing, New York 2022,

163-185.

Link

-

The Triumph of European Union Law in International Investment Law – The Phenomenon, the Problems, and the Solution.

In: Zeitschrift für ausländisches öffentliches Recht und Völkerrecht 81(4), 885-895 (2021). doi: https://doi.org/10.17104/0044-2348-2021-4-885.

Open Access

-

Investor Accountability: Indirect Actions, Direct Actions by States, and Direct Actions by Individuals.

In: Journal of International Dispute Settlement 13(2), 259-280 (2022). doi: https://doi.org/10.1093/jnlids/idab035 (with

Sergio Puig,

Steven Ratner).

Open Access

-

A New Frontier in International Investment Law: Adjudication of Host Citizen-Investor Disputes?

In: Heidelberg Journal of International Law 81(4), 969-1001 (2021). doi: https://doi.org/10.17104/0044-2348-2021-4-969.

Open Access

-

Contributory Fault and Investor Misconduct in Investment Arbitration.

In: German Yearbook of International Law 62 (2019), 629-633 (2021).

Link

-

Responding to Investor Misconduct: The Line between Lawful and Unlawful Responses and Apportionment in Cases of Unlawful Responses. In: Investors' International Law,

Jean Ho,

Mavluda Sattorova (eds.). Hart Publishing, Oxford 2021,

169-191.

Link

-

A New Energy Charter Treaty for the Clean Energy Future. In: The Global Energy Transition: Law, Policy and Economics for Energy in the 21st Century,

Peter Cameron,

Xiaoyi Mu,

Volker Roeben (eds.). Hart Publishing, Oxford 2021,

217-240.

Link

-

Contributory Fault in Foreign Investment Law. In: Versicherungsmechanismen im Recht,

Caspar Behme,

Martin Fries,

Johanna Stark (eds.). Mohr Siebeck, Tübingen 2016,

45-70.

Link

-

Legally Protecting Upstream Investments.

In: University of Eastern Finland Energy Law Review 1, 50-79 (2016).

-

Optional Dispute Resolution Clauses and Conditional Arbitration Agreements.

In: Asian International Arbitration Journal 9, 39-53 (2013).

Link

Blogposts

-

Aligning Legal Responsibility with Wrongfulness in the Calculation of Compensation in Investment-Treaty Disputes. Kluwer Arbitration Blog, 17 November 2023.

Link

-

Germany’s Trusteeship over Gazprom Germania: A Brewing Expropriation Claim?. EJIL:Talk!, 2022 (with

Sergio Puig,

Steven Ratner).

Link

-

New Options for Investor Accountability in ISDS. EJIL:Talk!, 2021 (with

Sergio Puig,

Steven Ratner).

Link

-

Causation in International Investment Law. Jus Mundi - Wiki Notes, 2020.

Link

-

The Only Thing We Have to Fear About Judicial Expropriation is the Fear of It. OpinioJuris, 20 May 2020.

Link

-

Standing Up to Investor Misconduct. Fifteeneightyfour, 25 June 2020.

Link

Working Papers

-

Extricating the Illegality Requirement from Judicial Expropriation. MPIL Research Paper Series, 2020.

Link

-

Extracting Legal Causation from International Investment Law. MPIL Research Paper Series, 2020.

Link

Media

Here is a puzzle: arbitral tribunals insist that states have regulatory space under the rule on fair and equitable treatment, yet, when they test for causation and calculate compensation, they forget about this.

They test whether the state’s conduct was causal, not whether the unfair and inequitable aspect of the state’s conduct was causal.

If there is causality, they award compensation that covers all of the investor’s losses, as opposed to limiting compensation to the losses caused by the unfair and inequitable aspect of the state’s conduct.

In this video, I put forward a theory on how to solve this puzzle.

Seventeen-minute video analysing decisions from an English court and a Luxembourgish court on the enforcement of ICSID arbitral awards from intra-European Union investment-treaty arbitrations.

You are the legal counsel for the investor an investment-treaty arbitration.

The investor looks like it has a good claim.

It also looks like the arbitral tribunal has jurisdiction to hear this claim, but your opposition surprises you: the investor has participated in corruption in the process of making its investment.

The evidence is overwhelming.

The case looks lost.

Is there anything that you can do?

In this video, I introduce a new strategy for defeating such jurisdictional objections, specifically using the doctrine of duress.

This video introduces a new research project: ‘The Rise of Domestic Courts in International Investment Law’. For more details on this research project, please use the following link: https://martin-jarrett.com/research-project-the-rise-of-domestic-courts-in-international-investment-law After detailing the background behind this research project, the main research question is introduced, which is: on account of the increasing involvement of domestic courts in investment-treaty disputes, how are they changing international investment law? This question is being tackled from multiple angles in the project.

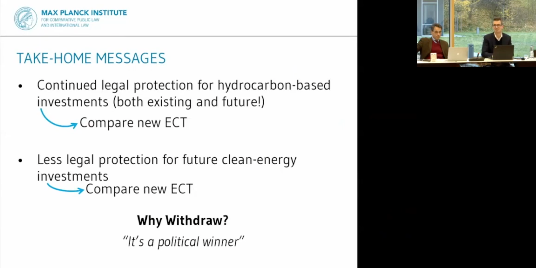

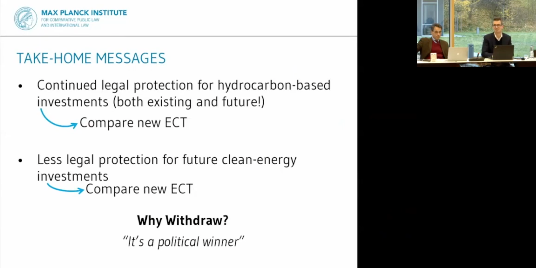

Over the past few months, a great drama has been played out in respect of the Energy Charter Treaty. After the long process of the modernisation of this treaty was brought to an end with the conclusion of a final draft in June 2022, various European states signaled their intention to withdraw: first Poland, then the Netherlands, Spain, France, and Germany. Now the European Union, Slovenia, and Austria are now mulling the possibility of withdrawing. Despite the conclusion of the modernisation process, why are these states withdrawing? Put simply, they do not believe that the Energy Charter Treaty is compatible with the implementation of the policies that we will be needed to achieve the energy transition. Interestingly, however, withdrawing from the Energy Charter Treaty does not mean that the treaty no longer binds a withdrawing state. Rather, its provisions can still continue to apply to it. What this means is that by withdrawing from the treaty, contracting states are effectively trying to kill the Energy Charter Treaty, but even after this ‘death’, the Energy Charter Treaty continues to survive, hence ’the Zombification of the Energy Charter Treaty’. In this video, I investigate whether, in its ‘zombified state’, the Energy Charter Treaty still inhibits the energy transition, with particular reference to how things would have been if the withdrawing states had signed the modernised Energy Charter Treaty.

In late June 2022, important news broke on the international legal regime applicable to states’ treatment of energy-focused investments: the contracting states to the Energy Charter Treaty had reached an in-principle agreement to amend it. In diplomatic speak, this amendment sought to ‘modernise’ the Energy Charter Treaty, particularly in light of the challenge posed by climate change. One of the pivotal changes in this new modernised Energy Charter Treaty is the change to the definition of ‘investment’. The importance of this definition cannot be overstated. It defines exactly what investments receive protection-status under the Energy Charter Treaty. Accordingly, if fossil fuel–based investments are excluded from its scope, it means that they do not have protection-status under the Energy Charter Treaty, with the result that investors with such investments cannot sue states under this treaty. The European Union pushed for such an exclusion, but there was pushback from other contracting states. What emerged was a kind of compromise: states could opt out of protection for fossil fuel–based investments. Does this political solution stand up legally, however? This video investigates this question. It identifies a number of issues that the drafters will have to address as they go about drafting up this compromise.

The reform process for ISDS at UNCITRAL is reaching its climax. Within the next few years, a treaty for ISDS 2.0 should emerge from this process. It is expected that one feature of ISDS 2.0 will be an appellate mechanism. It would hopefully address one of the main issues that has plagued ISDS 1.0, specifically the disunity of adjudicator-made jurisprudence in international investment law. Given this role for the appellate mechanism, a question that has frequently arisen during the negotiations at UNCITRAL has been: should a doctrine of precedent be adopted into ISDS 2.0? In this video, I offer my preliminary thoughts on this question.

In this video, I recount the adventures of the Antin v Spain arbitral award. And ‘adventures’ is the right word. While most arbitral awards are performed after their issuance, the arbitral award from Antin v Spain has been on a roller-coaster ride.

The first section of that ride was the jurisprudence of the European Court of Justice that culminated in the decision of Moldova v Komstroy. In that case, the European Court of Justice effectively ruled that the investment-treaty arbitration that was Antin v Spain was illegal under European law. Enforcement of the arbitral award in the European Union is now impossible. Where could the arbitral award be enforced? One potential jurisdiction was Australia. And, indeed, Australian courts have enforced the arbitral award.

But that action has provoked a response from the European Commission, which is now investigating whether payments to Antin under the Australian judgment would constitute (unlawful) European state aid. In a world where the European Commission does order Spain to retake the amount that it pays to Antin pursuant to the Australian judgment, does that amount to a good faith breach by Spain of the ICSID Convention? This is the question of the third chapter of this story and it is one that this presentation casts a light on.

It has been the news story of the year so far: the Djoković-Australia saga.

There are many fascinating elements to this saga, from the vaccination issue to the sporting story, specifically whether Djoković could win his 21st grand slam at the Australian Open.

But this saga was fundamentally a legal story.

In this video Dr. Martin Jarrett, Senior Researcher at the Max Planck Institute for Comparative Public Law and International Law, gives a comprehensive account of the legal story.

It focuses specifically on the difficult legal issues that the Djoković-Australia saga raised.

After looking through the various legal proceedings, a provocative question is considered at the end: what does this saga show about the health of the rule of law in Australia?

No other legal concept in international investment law provokes controversy like legitimate expectations. When arbitral tribunals have to apply it, they have to engage in a delicate balancing act. On the one side, there is investors’ interest in a stable regulatory regime for their investment activities, while, on the other side, there is states’ interest in changing that regime to better fit to the changing circumstances in the society over which they govern. Because balancing these interests is such a difficult task, any new jurisprudence on legitimate expectations is always significant. This video reports on such new jurisprudence: the legality requirement in legitimate expectations in International investment law.

In this video, Dr. Martin Jarrett, Senior Research Fellow at the Max Planck Institute for Comparative Public Law and International Law, describes this new jurisprudence, doctrinally critiques it, and proposes alternative jurisprudence to take its place.

In March 2018, the European Court of Justice handed down its decision in Slovakia v Achmea. This decision let off a Krakatoa-like eruption in the world of international investment law. Effectively, the European Court of Justice sought to interdict investment-treaty arbitrations between European investors and EU Member States, noting that these disputes make up a large portion of all investment-treaty arbitrations. As the dust has now settled after the initial blast, it is time to take stock and ask: what impact has the Achmea Decision actually had?

In this video, Dr. Martin Jarrett, Senior Research Fellow at the Max Planck Institute for Comparative Public Law and International Law, gives an overview of the legal issues that arose in international investment law post-Achmea and examines the responses to those issues.

In December 2020, China and the European Union concluded the long-awaited China-EU Investment Agreement, officially known as EU-China Comprehensive Agreement on Investment. Its significance cannot be overstated – it will provide the legal framework for European investment into China and Chinese investment into Europe. In this presentation Dr. Martin Jarrett, Senior Research Fellow at the Max Planck Institute for Comparative Public Law and International Law, gives an overview of the contents of the treaty and identify its positive and negative aspects.

As part of its broader push to ‘Unionise’ international investment law, the European Union has proposed the Investment Court System (from which the Multilateral Investment Court derives) to replace traditional investor-state arbitration (ISDS). In this presentation I give an overview of the two distinctive features of the Investment Court System relative to traditional investor-state arbitration, namely the random appointment of arbitrators from a pool of state-chosen potential arbitrators and the appellate tier. These overviews highlight the legal problems that the introduction of these two innovations could give rise to. To conclude, some comments are offered on the future challenges that the European Union has to overcome in making the Investment Court System a reality.

In this video, Dr. Martin Jarrett, Senior Research Fellow at the Max Planck Institute for Comparative Public Law and International Law, is interviewed on ‘Euronews Tonight’ (30 December 2020) on the China-EU Investment Agreement.

When governments began implementing tough Covid-related measures and the business world started hurting, law firms were quick to remind investors that they have possibilities to complain about these measures under investment treaties. Civil society groups saw the threat of a flood of investment-treaty claims. An offensive was started in the media to bring attention to this apparent problem. Further, a draft treaty was produced that would operate to stop the flood – 'Agreement for the coordinated suspension of investor-state dispute settlement with respect to COVID-19 related measures and disputes’.

In this video, Dr. Martin Jarrett, senior researcher at the Max Planck Institute for Comparative Public Law and International Law, analyses some of the legal technicalities of this proposed treaty.

Three issues are in focus:

- Can investors’ access to arbitration be suspended without their consent?

- If a state exercised its discretion and elected to suspend investors’ access to arbitration, would that suspension affect jurisdiction, admissibility, or merits?

- Is this proposed treaty necessary considering the defences that are available to states to defend themselves against Covid-related claims?

Legitimate expectations is the most controversial concept in the substantive law of international investment law. For many, it’s an unruly horse that investors ride to (undeserved) compensation. Working from this foundation, a doctrinal innovation has been developed to tame it: the idea that the investor cannot have legitimate expectations of certain performance by the state if it foresees that the state will probably not so perform. In this video, Dr. Martin Jarrett, Senior Research Fellow at the Max Planck Institute for Comparative Public Law and International Law, argues that this idea is doctrinally incorrect. But this doesn’t mean that the investor’s lack of due diligence is irrelevant to the state’s international responsibility. It is rather relevant via another concept, contributory fault. In the conclusion, he demonstrates how it assumes this relevance.

Could Indigenous Australians, who were not Australian citizens, be considered ‘aliens’ under the Australian Constitution? In a 4 – 3 decision, it decided that they could not. In this video, Dr. Martin Jarrett, Senior Research Fellow at the Max Planck Institute for Comparative Public Law and International Law, reviews the reasoning of the majority judges and the minority judges.

The bad news: there is a phobia among arbitral tribunals for investor-state arbitrations – the ‘phobia of judicial expropriation’. Now, to the good news: there is a cure for this phobia. That cure involves a two-step treatment regime. The first step is dropping the requirement that any taking of an investment by a domestic court must also involve some kind of serious procedural illegality before it can be labelled expropriatory. The second step is fully appreciating the role of causation in making any determination of judicial expropriation. This video explains those steps. The payoff is the realisation that the only thing we have to fear about judicial expropriation is the fear of it.

The bad news: there is a phobia among arbitral tribunals for investor-state arbitrations – the ‘phobia of judicial expropriation’.

Now, to the good news: there is a cure for this phobia.

That cure involves a two-step treatment regime.

The first step is dropping the requirement that any taking of an investment by a domestic court must also involve some kind of serious procedural illegality before it can be labelled expropriatory.

The second step is fully appreciating the role of causation in making any determination of judicial expropriation.

This video explains those steps.

The payoff is the realisation that the only thing we have to fear about judicial expropriation is the fear of it.

No other investment treaty compares to the Energy Charter Treaty (the ‘ECT’). It has 53 contracting parties, more than any other investment treaty. Further, it has given rise to more than 130 investor-state arbitrations, again, more than any other investment treaty. Accordingly, when the contracting parties announced in the Bucharest Declaration that the ECT had to be modernised in light of new realities, it was a significant moment in the history of international investment law. This presentation examines this modernisation process, specifically focusing on the legal questions that will come up in this process. It begins with the legal mechanics for amending the ECT.

The focus then shifts to the 'EU Text Proposal for the Modernisation of the Energy Charter Treaty’ (the ‘Draft Proposal’). First, it looks at the legal validity of the European Commission's attempts to harden the obligations of the Paris Agreement. Second, it compares the concept of legitimate expectations, as outlined in the Draft Proposal, to the jurisprudence on legitimate expectations that has emerged from the many recent ECT investor-Spain arbitrations. Third, the idea that withdrawing a subsidy to an investor by order of a 'competent authority’ could be a defence to a breach of a state's obligations vis-a-vis the treatment of investments is critiqued. It is argued that this idea is incompatible with a basic principle from the law on international responsibility, namely that domestic law should have no legally determinative role in answering the question of a state's international responsibility.

Presentations

30 Nov 2023

Aligning Legal Responsibility with Wrongfulness in Investment-Treaty Arbitrations

New York City Bar Association

Link to Video Recording

24 Jul 2023

The Battle over the Enforcement of Intra-EU Investment-Treaty Arbitral Awards

Monday Meeting

Max Planck Institute for Comparative Public Law and International Law

Link to Video Recording

07 Jul 2023

Public Policy–Based Challenges to Investment-Treaty Arbitral Awards

Workshop: The Rise of Domestic Courts in International Investment Law (Workshop 2)

Max Planck Institute for Comparative Public Law and International Law

05 Jun 2023

Case Review of 'Thiab v Western Sydney University'

Monday Meeting

Max Planck Institute for Comparative Public Law and International Law

29 Mar 2023

An Academic Perspective on a Potential Multilateral Investment Court

Establishment of a Multilateral Investment Court: Merits, Concerns & Future of ISDS

United Nations Headquarters

Link

Slides

(4021.5 KB)

28 Mar 2023

Towards Greater Investor Accountability

Side-Event to 45th Session of UNCITRAL Working Group III

United Nations Headquarters

Link

24 Nov 2022

Testing Fault-Aspect Causality in the Multilateral Investment Court

Workshop: Making a Multilateral Investment Court Beneficial for Sub-Saharan Africa?

University of the Witwatersrand

Programme

(651.9 KB)

28 Oct 2022

Public Policy–Based Challenges to Investment-Treaty Arbitral Awards

Workshop: The Rise of Domestic Courts in International Investment Law (Workshop 1)

University of Sydney

Programme

(178.3 KB)

15 Nov 2022

The Rise of Domestic Courts in Investment-Treaty Arbitration

Lunch-Time Talk

Faculty of Law, Saarland University

Link

25 Jul 2022

Fynerdale Holdings BV v. Czechia: A Critical Expansion of the Investment-Legality Requirement in Investment-Treaty Arbitration

Monday Meeting

Max Planck Institute for Comparative Public Law and International Law

15 Jul 2022

The Present and Future Protection-Status of Fossil Fuel–Related Investments under International Law

Conference: Global Energy Transition and Investment Disputes

University of Durham

Programme

(174.8 KB)

14 Jul 2022

The International Lawfulness of Germany’s Trusteeship over Gazprom Germania

Conference: Russian Aggression on Ukraine from the International Economic Law Perspective

Warsaw School of Economics

Programme

(456.0 KB)

23 May 2022 - 24 Mai 2022

The Legal Validity of Imposing Treaty Obligations on Individuals

Conference: The Concept of Obligation in International Law

University of Milano-Bicocca, Italy

Programme

(299.0 KB)

25 Feb 2022

Australian Enforcement of Eiser v Spain Arbitral Award: Responses from the European Commission

2022 Sydney Centre for International Law Year in Review Conference

University of Sydney

Video of Presentation

Programme

(462.3 KB)

17 Jan 2022

The Djokovic-Australia Saga: Legal Issues Behind the Drama

Referentenbesprechung

Max Planck Institute for Comparative Public Law and International Law

Video of Presentation

15 Nov 2021

Investment-Treaty Arbitration after Achmea

Referentenbesprechung

Max Planck Institute for Comparative Public Law and International Law

Video of Presentation

29 Oct 2021

Competition Authorities and Foreign Investors: Managing the Litigation Risk under the AfCFTA Investment Protocol

10th Annual Conference of the African Society of International Law: Africa and International Trade Law

African Union, Addis Ababa

Programme

08 Sep 2021

Overcoming the Assumption of Inevitable Bias of Judges on the Multilateral Investment Court: Time for a Doctrine of Precedent?

2021 ESIL International Economic Law Workshop

University of Stockholm

Programme

10 May 2021

European Union - China Comprehensive Agreement on Investment

Referentenbesprechung

Max Planck Institute for Comparative Public Law and International Law

Video of Presentation

15 Apr 2021

A New Frontier in International Investment Law: Adjudication of Host Citizen-Investor Disputes?

Tagung: Workshop of the ESIL International Economic Law Interest Group at the 2021 ESIL Catania Research Forum

University of Catania (online event)

Programme

08 Feb 2021

The Quiet Rise of the Investment Court System

Referentenbesprechung

Max Planck Institute for Comparative Public Law and International Law

Video of Presentation

30 Nov 2020

The Covid-19 Pandemic and Investment-Treaty Arbitration

Monday Meeting (MPIL)

Max Planck Institute for Comparative Public Law and International Law, Heidelberg, Germany

Video of Presentation

02 Nov 2020

The Status of Non-Citizen Indigenous Australians under The Australian Constitution

Monday Meeting (MPIL)

Max Planck Institute for Comparative Public Law and International Law, Heidelberg, Germany

Video of Presentation

22 Jun 2020

The Modernisation of the Energy Charter Treaty

Monday Meeting (MPIL)

Max Planck Institute for Comparative Public Law and International Law, Heidelberg, Germany

Video of Presentation

29 Feb 2020

The Challenges of Creating a Doctrine of Precedent for International Investment Law

Conference: South Asia in the Era of International Courts and Tribunals

South Asian University, New Delhi, India

29 Jan 2020

Overcoming the Challenges of Embedding Counterclaims into the Framework of International Investment Law

Workshop: Trade and Investment Law Timeout Session

Department of Foreign Affairs and Trade, Canberra, Australia

24 Oct 2019

Imposing Directive-Based Human Rights Obligations on Investors in International Investment Law

Conference: Socially Responsible Foreign Investment under International Law

Catholic University of Portugal, Lisbon, Portugal

Programme

(553.2 KB)

19 Sep 2019

The Potential for Creating Consistent Investment Treaty Case Law via the Investment Tribunal System

Conference: ILA 2019 Regional Conference

University of Minho, Braga, Portugal

Programme

15 Sep 2019

Shaping the Multilateral Investment Court System into the Chinese Mould

Conference: Multilateral Reform of Investor-State Dispute Resolution: A Dialogue among Different Approaches

The Silk Road Institute for International and Comparative Law, Xi'an Jiaotong University, China

Programme

12 Sep 2019

Ensuring the Fairness of Investor Obligations

Workshop: 2019 ESIL International Business and Human Rights Workshop

National and Kapodistrian University of Athens, Athens, Greece

04 Sep 2019

Granting Standing to Natural Persons and Local Communities for Human Rights-Based Claims in Investment Arbitration

Workshop: The Legitimacy of International Investment Law and Arbitration in Protecting Human Rights

PluriCourts, Oslo, Norway

Programme

19 Jul 2019

The Validity of Investor Obligations in Investment Treaties

Conference: Fourth African International Economic Law Network Biennial Conference

Strathmore University, Nairobi, Kenya

20 Jun 2019

Fighting Corruption via Effective Transparency Obligations and Civil Participation in Investment Treaties

Workshop: Corruption Democracy and Human Rights: Exploring New Avenues in the Fight Against Corruption

European University Institute, Florence, Italy

16 May 2019

A Theory of Causation for International Investment Law

Workshop: ESIL-ELTE Law School Joint Workshop on 'Attribution, causality and evidentiary rules: Mere technicalities or the heart of the matter? Secondary rules of primary importance'.

Eötvös Loránd University of Budapest, Budapest, Hungary

Programme

(264.1 KB)

07 May 2019

The Reactionary Police Powers Defence

Conference: 12th Annual McGill Graduate Law Conference

McGill University, Montreal, Canada

02 May 2019

The Eastern Shift in International Investment Law

Workshop: 2019 CIBEL Global Network Young Scholars Workshop

University of New South Wales, Sydney, Australia

22 Feb 2019

State Responsibility for the MH17 Incident

Conference: 2019 SCIL ‘Year in Review’

University of Sydney, Sydney, Australia

15 Feb 2019

Reimaging Expropriation in International Investment Law

Workshop: ANZSIL International Economic Law Interest Group 2019 Workshop

University of Canterbury, Christchurch, New Zealand

13 Dec 2018

The Defence of Mismanagement in International Investment Law

Presentation for the monthly academic staff meeting of the Centre for Energy, Petroleum and Mineral Law and Policy

University of Dundee, Dundee, United Kingdom

03 Dec 2018

“In Accordance with Host State Law”-Clauses, Inherent Legality, and Good Faith Requirements

Workshop: ‘Investment Protection Standards and the Rule of Law’ (an event organised by the International Law Association’s Committee ‘Rule of Law and International Investment Law’)

University of Vienna, Vienna, Austria

04 May 2018

Rethinking Expropriation of Intellectual Property Investments

Conference: Free Trade, Public Interest and Reality: New Generation Free Trade Agreements and National Regulatory Sovereignty

Hungarian Academy of Sciences, Szeged, Hungary

20 Apr 2018

Environmental Warning Labels: the Perspective from International Investment Law

Conference: Contemporary Challenges to International Law and Policy on Sustainable Development, Energy, Climate Change, Environmental Protection, Intellectual Property and Technology Transfer

Masaryk University, Brno, Czechia

08 Aug 2017

An Overview of Contributory Fault Defences in International Investment Law

Workshop dedicated to topic

University of Sydney, Sydney, Australia

29 Jan 2016

Intellectual Property Investments and the Locality Condition for Jurisdiction

Conference: 2nd Kobe Seminar on International Investment Law 2016

Kobe University, Kobe, Japan

13 Nov 2015

Causation, Expropriation, and Taxation

Conference: ‘Settlement of Tax Disputes Under International Law’

University of Luxembourg, Luxembourg City, Luxembourg

08 May 2015

Contributory Fault in Foreign Investment Law

Workshop: Versicherungsmechanismen im Recht

Ludwig Maximilian University of Munich, Munich, Germany

26 Feb 2015

Expropriation of Upstream Assets

Conference: Energy Transitions

University of Eastern Finland, Joensuu, Finland

Teaching

April – Juli 2022

Faculty of Law

University of Heidelberg

Apr. – July 2021

Faculty of Law

University of Heidelberg

Sep. - Dec. 2019

Faculty of Law and Economics, University of Mannheim

University of Mannheim, Mannheim, Germany

Sep. - Dec. 2019

Faculty of Law and Economics,

University of Mannheim, Mannheim, Germany

Feb. 2019

Faculty of Law,

University of Sydney, Sydney, Australia

Sep. - Dec. 2018

Faculty of Law and Economics,

University of Mannheim, Mannheim, Germany

Sep. - Dec. 2018

Faculty of Law and Economics,

University of Mannheim, Mannheim, Germany

Sep. - Dec. 2018

Faculty of Law and Economics,

University of Mannheim, Mannheim, Germany

Feb. - Jun. 2018

Faculty of Law and Economics,

University of Mannheim, Mannheim, Germany

Sep. - Dec. 2017

Faculty of Law and Economics,

University of Mannheim, Mannheim, Germany

Sep. - Dec. 2017

Faculty of Law and Economics,

University of Mannheim, Mannheim, Germany

Feb. - Jun. 2017

Faculty of Law and Economics,

University of Mannheim, Mannheim, Germany

Sep. - Dec. 2016

Faculty of Law and Economics,

University of Mannheim, Mannheim, Germany

Feb. - Jun. 2016

Faculty of Law and Economics,

University of Mannheim, Mannheim, Germany

Sep. - Dec. 2015

Faculty of Law and Economics,

University of Mannheim, Mannheim, Germany

Feb. - Jun. 2015

Faculty of Law and Economics,

University of Mannheim, Mannheim, Germany

Sep. - Dec. 2014

Faculty of Law and Economics,

University of Mannheim, Mannheim, Germany

Feb. - Jun. 2014

Faculty of Law and Economics,

University of Mannheim, Mannheim, Germany

Feb. - Jun. 2014

Faculty of Law and Economics,

University of Mannheim, Mannheim, Germany

Nov. 2013

The School of Humanities, Social Sciences and Economics,

International Hellenic University, Thessaloniki, Greece

Sep. - Dec. 2013

Faculty of Law and Economics,

University of Mannheim, Mannheim, Germany

Feb. - Jun. 2013

Faculty of Law and Economics,

University of Mannheim, Mannheim, Germany

Participation in Conferences at Home and Abroad

46th Session, UNCITRAL Working Group III: Investor-State Dispute Settlement Reform Report of the Working Group, Vienna International Centre, 09.10.2023 - 13.10.2023

45th Session, UNCITRAL Working Group III: Investor-State Dispute Settlement Reform Report of the Working Group, United Nations Headquarters, 27.03.2023 - 31.03.2023

44th Session, UNCITRAL Working Group III: Investor-State Dispute Settlement Reform Report of the Working Group, Vienna International Centre, 23.01.2023 - 27.01.2023

Exploratory Workshop, Evidence-Based Policy Making Around the African Continental Free Trade Area: Bridging the Gap between Research and Practice (link), Deutsche Gesellschaft für Internationale Zusammenarbeit und Deutsches Institut für Entwicklungspolitik (online event), 29.03.2021 - 30.11.2021

40th Session, UNCITRAL Working Group III: Investor-State Dispute Settlement Reform Report of the Working Group, Vienna International Centre (online event), 08.02.2021 - 12.02.2021

39th Session, UNCITRAL Working Group III: Investor-State Dispute Settlement Reform

Report of the Working Group, Vienna International Centre (online event), 05.10.2020 - 09.10.2020

Resumed 38th Session, UNCITRAL Working Group III: Investor-State Dispute Settlement Reform, Vienna International Centre, 20.01.2020 - 24.01.2020

Honours

Research Grant

- Amount: EUR 15,000

- Funder: Fritz Thyssen Stiftung

- Programme: Tagungen

- Purpose: workshop 2 'The Rise of Domestic Courts in International Investment Law'

Research Grant

- Amount: EUR 20,000

- Funder: Max Planck Society

- Programme: Kick-Off Workshop

- Purpose: workshop 1 'The Rise of Domestic Courts in International Investment Law'

Research Grant

- Amount: EUR 53,800

- Funder: Volkswagen Stiftung

- Programme: Knowledge for Tomorrow

- Purpose: workshop 'Making a Multilateral Investment Court Beneficial for Sub-Saharan Africa?'

Research Grant

- Amount: EUR 250

- Funder: European Society of International Law

- Programme: ESIL Travel Grants

- Purpose: Paper-presentation (Athens)

Research Grant

- Amount: EUR 2,116

- Funder: DAAD

- Programme: Kongressreiseprogramm

- Purpose: Paper-presentation (Nairobi)

Research Grant

- Amount: EUR 200

- Funder: European Society of International Law

- Programme: ESIL Travel Grants

- Purpose: Paper-presentation (Budapest)

Research Grant

- Amount: EUR 3,897

- Funder: DAAD

- Programme: IPID4all

- Purpose: Research-stay at the University of Sydney

Memberships

Miscellaneous

Administrative Duties

Since June 2021: elected representative of the scientific staff at Max Planck Institute for Comparative Public Law and International Law

Peer-Review Activities

Peer-Reviewer for:

- Cambridge Law Journal

- Heidelberg Journal of International Law

- Journal of International Economic Law

- Journal of World Investment and Trade

- Yearbook of International Investment Law and Policy

Research Featuring in Mass Media:

Standing Up to Investor Misconduct (10 October 2019).

• Source: Radio Regenbogen (link to interview)

• Description: radio interview for the programme 'Campus-Report' on sanctioning investor misconduct under international law and the desirability of an international court for investor-state disputes.

'It was hard to look at their faces': MH17 victim's mother welcomes charges (20 June 2019).

• Source: Sydney Morning Herald (link to story)

• Description: advised journalist on the options for seeking to hold Russia to account for the downing of MH17 under international law.